Mastering Crypto Day Trading with AvaTrade

Introduction to Crypto Day Trading via CFDs

Cryptocurrency day trading through Contracts for Difference (CFDs) is becoming increasingly popular. The aim of day trading in any market is to earn small, incremental profits. The volatility and wide price ranges of digital currencies, however, mean that crypto day traders can actually earn bigger profits within a short period of time. Crypto CFDs also offer other practical advantages that allow traders to exploit exciting short-term opportunities in the market.

Benefits of Crypto CFD Day Trading

Quick Profits

One of the main attractions of crypto CFD day trading is the potential for rapid gains. Due to the high volatility of cryptocurrencies, significant price movements can occur within short periods of time, providing numerous profitable opportunities each day. Just remember that high rewards come with high risks, which means losses can also come hard and fast.

Profiting from Both Rising and Falling Markets

Crypto CFDs allow traders to profit from both upward and downward price movements. By taking long or short positions, traders can exploit market trends and maximise their profit potential regardless of market direction.

Double Your Investment with Leverage

Crypto CFDs are leveraged products. With only a small margin capital amount, you can control a relatively larger position in the market with the potential for even bigger profits. However, leverage should be used carefully because it can also amplify your potential losses.

No Storage Headache

When trading crypto CFDs, you only speculate on the underlying prices. You do not take any ownership of the digital coins and therefore do not have to worry about how to store them securely in digital wallets.

24/7 Market – it applies to crypto, not specifically to CFD

Unlike other financial derivatives, cryptocurrencies are available for trading round-the-clock, every day. Such accessibility expands the opportunities for day traders.

Risks and Challenges

Market Volatility

Crypto markets are highly volatile, and while this can expose day traders to lucrative opportunities, there is also the risk of big losses within a short period of time. The use of leverage can further magnify the risk.

Emotional Challenges

The fast-paced nature of day trading can lead to emotional stress. Earning quick profits can fuel greed and reckless trading, whereas losses can be very emotionally draining to day traders. It is, therefore, important to have a trading plan that will foster trading discipline and consequently help you avoid negative emotions that will impact your trading activity.

Choosing the Right Broker to Day Trade Cryptocurrencies

Security

Security is paramount when choosing a broker for crypto day trading. Ensure the broker is highly regulated and uses advanced security measures to protect your funds and personal information.

Choice of Instruments

A diverse selection of cryptocurrencies and trading pairs allows for more opportunities. Choose a broker offering a wide range of instruments to trade.

Trading Platforms

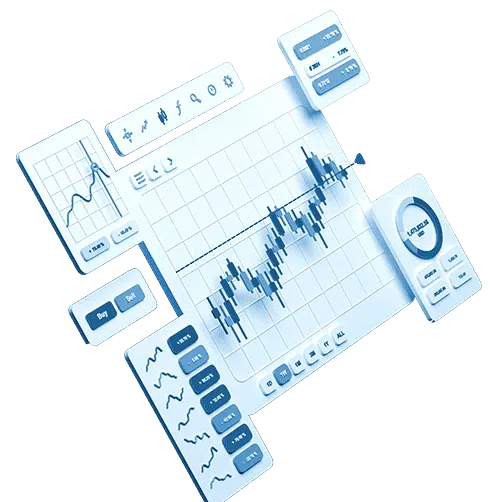

A reliable and user-friendly trading platform is crucial for executing trades efficiently. Look for platforms with advanced charting tools, real-time data, fast execution speeds, as well as other tools and resources that will allow you to trade better.

Client Support

Excellent customer support can help resolve issues quickly and provide guidance. Choose a broker with responsive and knowledgeable support staff that can speak your language.

Popular Crypto Day Trading Strategies

Trend Following

This strategy involves identifying and following the current market trend. Traders look for optimal price points to enter positions in the direction of the trend, aiming to profit from continued price movements.

Breakout Trading

Breakout trading focuses on entering positions when prices break through key support or resistance levels. This strategy aims to capture price momentum following a breakout.

Scalping

Scalping involves making multiple trades throughout the day to profit from small price movements. It requires quick decision-making and precise execution.

Range Trading

Range trading capitalises on price oscillations within a defined range. Traders buy at the lower boundary seeking to exit at the upper boundary or sell at the upper boundary and exit at the lower boundary.

News-Based Trading

This strategy involves trading based on news events and market reactions. Crypto traders monitor news events such as regulatory updates, exchange listings, technology updates or coin supply updates.

Tips for Success

Educate Yourself

Continuous learning is vital for success in the ever-evolving crypto day trading world. Stay updated with market news and trends, trading strategies, as well as technical analysis techniques.

Start Small

Begin with a small trading capital to minimise risk while gaining experience. As your skills improve, gradually increase your investment.

Set Realistic Goals

Set achievable trading goals based on your experience and risk tolerance. Setting realistic goals will help you maintain disciplined trading as well as avoid making common trading mistakes such as emotional and impulsive decisions.

Manage Risk

Effective risk management is crucial in the volatile crypto markets. Use stop-loss orders, diversify your trades, and never risk more than you can afford to lose.

Control Emotions

Maintain discipline and avoid letting emotions drive your trading decisions. Stick to your trading plan and strategies, and commit to only making logical, informed decisions in the market.

Best Practices

Keep a Trading Journal

Document your trades, strategies and outcomes in a trading journal. This practice helps bring accountability to your trading activity as well as identify patterns and areas for improvement.

Use Stop-Loss Orders

Stop-loss orders protect your capital by automatically closing losing positions at predetermined levels. Crypto markets can be very volatile and unpredictable. The stop-loss tool is therefore essential for managing risk.

Utilise Technical Analysis

Technical analysis tools and indicators can help identify patterns from past price action which can help predict future price movements. Technical analysis is particularly useful because of the short-term nature of crypto day trading.

Continuous Learning

The crypto market is constantly evolving. Stay informed about new developments, strategies, and technologies to maintain a competitive edge.

Common Mistakes to Avoid

Lack of Research

Entering trades without proper research and analysis can lead to losses. Always conduct thorough research before making trading decisions.

Overtrading

Day trading may be short-term, but it is important to focus on quality rather than quantity. Excessive trading can deplete your capital, increase trading costs, and even cause you emotional stress.

Ignoring Risk Management

Risk is always present in crypto markets. It is, therefore, important to have a solid risk management plan that will not only guarantee that you survive in the market, but also thrive in the long term.

Start Day Trading Crypto with AvaTrade

Crypto day trading through CFDs with AvaTrade is a flexible way to capitalise on the numerous opportunities available in the dynamic cryptocurrency market. With comprehensive educational resources, competitive pricing and advanced trading tools, AvaTrade provides the ideal environment for day trading crypto successfully.

Learn more, explore trading strategies, and start trading now