How to trade stocks

You can trade stocks as CFDs here at AvaTrade

- Understanding the Stock Market

- What determines stock value?

- How to Get into the Stock Market

- Why CFD Stocks Trading is so much easier

- Making a profit in a bearish market

- Advantages of leveraged stock trading

- The Trading Platform is Paramount

Understanding the Stock Market

If you are unfamiliar with the stock market, then this trader’s guide will assist you in understanding this market and how you can easily trade stocks with AvaTrade online. The stock market is a giant international market where stocks, or shares of ownership of a company, are traded.

The vast majority of this trading is now done online; however, in the past, it was done over the phone, or in person, directly with one’s broker. All around the world, people trade stocks, hoping to profit from price changes in stocks over time. Stock prices change continuously during trading hours, offering traders many lucrative trading opportunities.

However, before we get started with the specifics of the stock market, it’s important to point out that when you trade stocks in a conventional sense, you’re buying into a company, in very small amounts. The more stocks you own, the greater your share in the company. Publicly traded stocks number in the thousands, and many stocks are being listed or delisted each and every day.

The value of a stock is dependent on a wide variety of factors, including the fundamentals of the company, socio-economic issues, geopolitical issues, inflation, unemployment, taxation, and a host of others. At any given time, all of these factors are working together – often in opposite directions – to influence the price of the company’s stock. But perhaps the biggest drivers of stock prices are speculation and perception. The more people that believe a stock is likely to move up or down, the greater the likelihood that they will move the stock price in a particular direction.

What determines stock value?

Stock prices are only calculated when a company decided to go public and makes its initial public offering. The company will primarily pay an investment bank that makes use of complex valuation techniques that determine the results of how many shares will be offered and at what exact price.

As a company’s total value is its Market Capitalisation that is represented by its Stock Price once the company goes public, this is published on the stock markets. Market capital is equal to the stock price, but multiplied by the actual number of shares. E.g.: If a company’s value is estimated at $100 million, it may issue 10 million shares at $10 per share.

How to Get into the Stock Market

The simplest way to get into the stock market is to create a trading account with an online brokerage, such as AvaTrade. To create an account, simply fill in the short registration form on the website and create a password. Once your account is set up, you will be required to deposit a minimum amount of trading capital. Minimum deposit amounts can vary significantly from broker to broker and can range from $100 to $1,000. At AvaTrade, the minimum deposit amount is only $100 on a credit card.

After you have deposited the minimum amount and once your account is approved, you will be able to start buying and selling stocks or other assets that AvaTrade offers, such as forex trading, indices and commodities.

Typically, brokerages will take a commission on every trade, or they will charge by spread. The spread is the difference between the BUY and SELL price of an asset. If the brokerage charges by the spread, it will take a percentage of the spread, such as 1%, instead of charging a flat commission on every trade. At the end of the year, if you generate a profit from your trades, you will be required to pay a capital gains tax, depending on the country you live in.

Why CFD Stocks Trading Beats Investing in Stocks

When you trade CFD stocks like Google, Coca Cola, Apple or Barclays, you’re not buying shares in a company; you are agreeing to a contract (CFD) with the broker to settle the difference in value between the entry/exit prices of that particular stock. Prices are always moving up and down, but traders can always take advantage of these price fluctuations, even in a bearish market. To learn more, visit our short selling page.

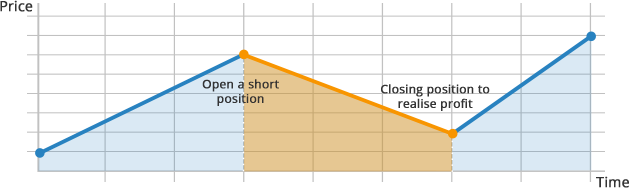

Making a profit in a bearish market

Since you’re not taking possession of the tradable asset, there is leverage of up to, which means that for a small investment, you can trade substantially larger stock volumes. It is important to understand though that CFD stock trading has an upside and a downside, and sensible trading practices are encouraged at all times.

The upside is that with higher amounts of leverage, it is much easier to generate higher returns if you make a profitable trade. The downside is that it is also significantly easier to lose money if you make a bad trade. So, before you use large amounts of leverage for CFD trading, you need to make sure that you have done your homework on your trades and that you are financially responsible.

Advantages of leveraged stock trading

- Leverage trading enhances your initial capital

- Increase your profit potential but beware of associated risks

- Increases your exposure to the markets on a particular position

- Allows you to fully capitalise on market investments

- Leverage also allows traders to offset capital losses from other trading positions

- Using leverage effectively can be pivotal as part of a balanced, well-managed trade portfolio

The Trading Platform is Paramount

One of the most important aspects of trading stocks is the trading platform that you use. We feature several of the most powerful, innovative and robust trading platforms on the market. You’ll be able to make use of multiple trading graphs, trading tools and other features to enhance your overall trading experience. Plus, you’ll be able to track the performance of your stock portfolio, forex, commodities and indices trading deals in real-time.

We regularly update our traders with the latest news, educational resources and market commentary to keep you well informed about the hottest trends, movements and news from the world of stocks trading. Set a Successful Stock Trading Plan before you begin to trade. Know the risks and potential positive outcomes prior to entering a Stock trading position. The use of limit and stop orders as well as leverage, have a substantial role to play.

How to trade stocks main FAQs

- Do I need to diversify when trading stocks?

The notion of diversification, or spreading your money across a number of market sectors or asset classes, is a concept that applies to investing for the long-term. When you are trading stocks, you are looking to make a profit from the short-term movement of the stock. In this case diversification won’t benefit you, and in some cases, it could even harm your results. If you are looking to profit from the movement in stocks often times it is stocks within the same sector that are making the best moves, which means you’ll often want to concentrate your trading rather than diversify.

- How can I find the best opportunities when trading stocks?

There are always good opportunities in the markets and you don’t have to find the best to make a profit. The very best way to locate stock trading opportunities is to become intimately familiar with the market. The easiest way to do this is to begin with a single sector, like technology or the financial stocks. When you are constantly monitoring the behaviour of a stock or a set of stocks you will begin to notice patterns in the prices that you can take advantage of. Start by creating a small list of 10-20 stocks that you follow on a regular basis and work your way up from there.

- How will I know when to sell my stocks?

You should have a plan for every trade you make. That means knowing why you want to buy or short the stock, where is a good area to place your buy/sell order, and knowing how much the stock will move before you sell. You should already know when to sell before you buy the stock. That means when to sell for a profit, or when to cut your losses. That takes all the emotion out of the trade because your trading decisions won’t be dictated by fear or greed.

We recommend you visit our trading for beginners section for more articles on how to trade Forex and CFDs.

Other recommended guides: