Forex Market Structure

The Forex market, also known as FX or the Foreign Exchange market, stands as the largest and most liquid financial market in the world. With trillions of dollars traded daily, understanding its structure is crucial for anyone looking to succeed in currency trading. This guide breaks down the complexities of the Forex market into simple, actionable insights to help you navigate this vast market with confidence.

Overview of the Forex Market

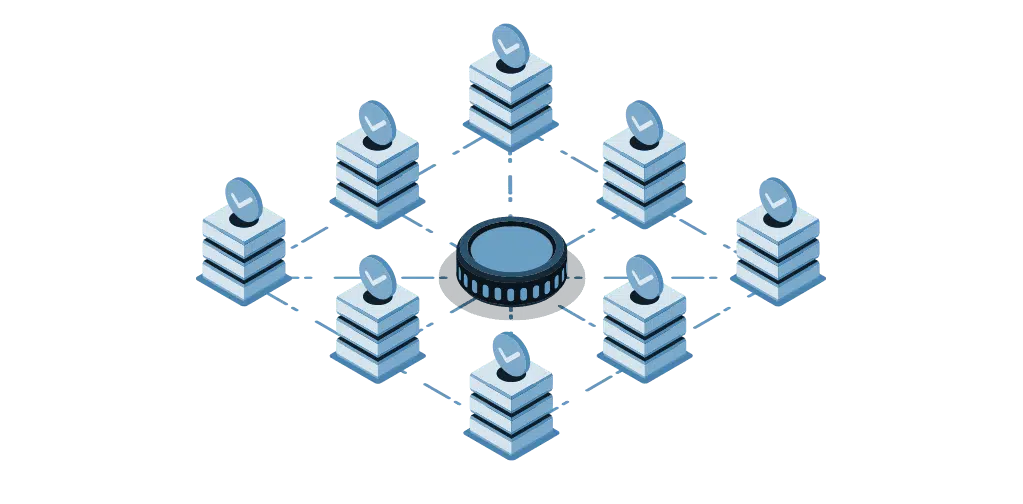

The Forex market operates on a global scale, with trading occurring 24 hours a day, five days a week. Unlike other traditional financial markets that have centralised exchanges, the Forex market is decentralized. This means trading takes place directly between participants in the over the counter (OTC) market, which consists of a network of banks, brokers, financial institutions, and individual traders.

This global, decentralized structure allows for continuous trading as the market follows the sun across different financial centres including Syndey, Tokyo, London and New York. The sheer size and liquidity of the Forex market make it a unique and dynamic environment, where opportunities and risks are abundant.

Three Major Markets in Forex

The Forex market can be divided into three major segments:

- Spot Market

- Forward Market

- Futures Market

Each of these markets plays a crucial role in the overall structure of Forex trading.

1. Spot Market

The Spot Market is where one currency is exchanged for another at current market prices. The quantity and price are defined and settlement is done within two business days. The two-business day settlement is usually because of differences in time zones and specific currency cut-off times. This is the market where retail traders operate, as it involves real-time exchange rate quotes.

Characteristics:

- Instantaneous Transactions – Trades in the Spot Market are executed immediately at the current market price.

- Direct Exchange – Involves the physical exchange of one currency for another, with settlements typically occurring within two business days due to bank procedures.

- High Liquidity – The Spot Market is extremely liquid, especially for major currency pairs like EUR/USD, GBP/USD and USD/JPY.

Tip: Most retail traders operate in the Spot Market, where trades are executed instantly, making it ideal for day trading strategies. Understanding the Spot Market is fundamental for any trader looking to enter the Forex market.

2. Forward Market

The Forward Market involves contracts to buy or sell currencies at a future date at a predetermined price. Unlike the Spot Market, these transactions are not standardized and are often customized to meet the specific needs of the parties involved. Therefore, in a forward contract, the exchange rate is fixed now, but settlement is at a later date.

Characteristics:

- Customizable Contracts – Terms of the contracts, including the amount and settlement date are tailored to the needs of the participants.

- Hedging Tool – Commonly used by corporations and financial institutions to hedge against future currency risk.

- No Centralized Exchange – Forward contracts are traded over the counter (OTC) with the agreements made directly between parties.

Tip: The Forward Market is particularly useful for businesses and financial institutions looking to protect themselves against unfavourable currency fluctuations. If you’re a trader dealing with international transactions, understanding the Forward Market can help you mitigate risks. Forward contracts are generally illiquid because of their high customization.

3. Futures Market

The Futures Market is similar to the Forward Market but with key differences. Futures contracts are standardized agreements traded on exchanges which makes them more accessible and liquid than forward contracts.

Characteristics:

- Standardized Contracts – Unlike forward contracts, futures contracts have standardized terms and are traded on exchanges.

- Regulated Trading – Futures trading occurs on regulated exchanges, providing greater transparency and security.

- Leverage and Speculation – The Futures Market is popular among speculators due to the availability of leverage which allows traders to control large positions with a relatively small capital outlay.

Tip: Futures contracts are often used by both speculators and institutions. The market is ideal for well-capitalized retail traders who want to operate within a regulated and centralized market. Institutions also use the futures market for the practical purpose of hedging and providing stability to their cash flows.

Primary Market Participants in Forex

The Forex market consists of a diverse range of participants, each playing a unique role in its functioning. Understanding who these participants are and how they influence the market is crucial for any trader.

Financial Institutions

Large financial institutions, including major commercial banks, investment banks, and hedge funds are at the top of the Forex market structure. They participate in the interbank market by settling huge transactions between themselves and their clients.

Impact: Financial institutions contribute to market liquidity, making it easier for other participants to execute trades. They also engage in speculative trading, which can influence currency prices.

Central Banks

Central banks are among the most influential players in the Forex market. They manage their local country’s currency reserves and implement monetary policy to maintain financial stability and promote economic growth. Central banks often intervene in the Forex market to influence exchange rates, either by directly buying or selling their assets (treasuries and bonds) or indirectly by implementing monetary policies such as interest rate adjustments.

Impact: Central bank interventions can lead to significant volatility in the Forex market. For example, a sudden interest rate hike by the Federal Reserve can cause the US dollar to appreciate rapidly against other currencies.

Multinational Corporations

Multinational Corporations engage in Forex trading primarily to perform their day-to-day activities and to hedge against currency risk. Multinationals are always exposed to fluctuations in exchange rates, which can impact their bottom line. By using the Forward Market or options, they can protect themselves from adverse currency movements.

Impact: Corporate transactions in the Forex market are often substantial and can affect exchange rates, especially when large amounts of currency are exchanged.

Speculators and Retail Traders

Retail traders are individuals who participate in the Forex market through online trading platforms. Although retail traders make up a smaller portion of the market compared to institutions, their collective activity can still influence market dynamics, particularly for less liquid currency pairs.

Impact: Retail traders typically engage in speculative trading, aiming to profit from short-term changes in exchange rates. Their actions can add to market volatility, especially in the Spot Market.

Market Size and Liquidity

The Forex market is the largest financial market in the world, with an average daily trading volume exceeding $7 trillion. This immense size and liquidity provide several advantages for traders:

- Tight Spreads – High liquidity ensures that spreads (the difference between the bid and ask prices) remain tight, reducing transaction costs.

- Efficient Execution – The large volume of trades allows for fast and efficient execution, minimizing slippage and ensuring that orders are filled at the desired price.

- Reduced Market Manipulation – The sheer size of the market makes it difficult for any single participant to manipulate prices, thereby creating a more level playing field for traders.

Tip: High liquidity is one of the Forex market’s most attractive features. It makes it easier for traders to enter and exit positions without significant price distortion. Understanding the liquidity dynamics of different currency pairs can help you make more informed trading decisions.

Currency Pairs: Majors, Minors and Exotics

In the Forex market, currencies are traded in pairs. Each pair consists of a base currency and a quote currency, with the price reflecting how much of the quote currency is needed to purchase one unit of the base currency. For instance, if the price of EURUSD is 1.1000, it means that you will require 1.1000 USD (quote currency) to buy 1 EURO (base currency).

Major Currency Pairs

Major currency pairs are the most traded in the Forex market and involve the world’s most stable and liquid currencies. There are 8 major currencies (USD, EUR, GBP, AUD, NZD, CAD, CHF, JPY). There are however 7 currency pairs because all of them have the USD as either the base or quote currency. Examples include:

- EURUSD (Euro/US Dollar)

- GBPUSD (British Pound/US Dollar)

- USDJPY (US Dollar/Japanese Yen)

- USDCHF (US Dollar/Swiss Franc)

Characteristics:

- High Liquidity – Major pairs benefit from tight spreads and high liquidity, making them popular among traders.

- Lower Volatility – These pairs tend to be less volatile than others, offering more predictable price movements.

Minor Currency Pairs

Minor currency pairs, also known as cross-currency pairs, are pairs of major currencies that do not include the US dollar. Examples include:

- EURGBP (Euro/British Pound)

- EURJPY (Euro/Japanese Yen)

- GBPJPY (British Pound/Japanese Yen)

Characteristics:

- Moderate Liquidity – Minors are less liquid than majors but still offer substantial trading opportunities.

- Higher Volatility – These pairs can be more volatile, providing potential for higher profits and risks.

Exotic Currency Pairs

Exotic currency pairs involve one major currency and one currency from a smaller or emerging economy. Examples include:

- USDTRY (US Dollar/Turkish Lira)

- EURTRY (Euro/Turkish Lira)

- USDZAR (US Dollar/South African Rand)

Characteristics:

- Lower Liquidity – Exotics have wider spreads and lower liquidity, making them more expensive to trade.

- High Volatility – These pairs are highly volatile and often influenced by geopolitical events and economic instability.

Tip: While exotic pairs can offer significant trading opportunities, they are also riskier. It’s important to understand the factors that drive these currencies before trading them. Read our guide on How to Trade Forex to learn more!

How Market Structure Affects Trading Strategies

The structure of the Forex market plays a crucial role in determining the best trading strategies. Here’s how:

- Spot Market – Ideal for day traders and scalpers due to its high liquidity and immediate execution.

- Forward and Futures Markets – Better suited for long-term traders or institutions looking to hedge against future currency risk.

- Currency Pairs – Choosing the right pair is essential. The majors are generally safer for beginners, while minors and exotics offer more risk and reward potential.

Understanding the market structure can also help you predict price movements more accurately. For example, knowing that central banks are active in the market might lead you to anticipate greater volatility around policy announcements.

Conclusion

The Forex market’s structure is complex but understanding it is essential for developing effective trading strategies. From the types of markets to the roles of different participants, each element influences the opportunities and risks you’ll encounter as a trader. By aligning your strategy with the market’s structure, you will be able to make informed decisions when trading and capitalise on the best prevailing and emerging opportunities.

Ready to put this knowledge into practice? Open a demo account with AvaTrade and start exploring the Forex market structure in real-time, risk-free.